Hello Dear friends, Welcome to KhanStudy.in. In this article we are going to study Harrod Domar Model of Economic Growth in details. So, without any delay let’s start to read.

Table of Contents

Harrod Domar Model of Economic Growth

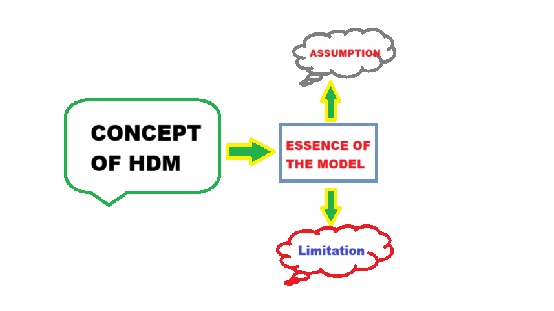

The Harrod-Domar Growth Model is a classical economic theory that explains economic growth through savings and investment. It emphasizes the role of capital accumulation, stating that growth depends on the savings rate and capital-output ratio. The model highlights challenges like instability and stagnation, influencing development policies in emerging economies.

Two economists R.F. Harrod and E.D. Domar worked almost concurrently to develop this model of economic growth. The ideas in the two models are different in details but are so similar in their essence that that two models have got integrated and are presented as Harrod-Domar Model.

HDM considered demand as well as supply side of the investment process and hence, integrated the Classical and Keynesian Analysis.

Essence of the Harrod-Domar Model of Growth

If there is increase in productive capacity of the economy without parallel increase in real national income, it may lead to under-utilization of new capital, there may be lack of other factors of production or the new capital may be substituted for labour. In simple words, unless and until capital formation and increase in real national income go side by side, growth will not sustain for long.

Assumptions of the HDM

- There is full employment equilibrium of national income initially.

- No government interference.

- It is a closed economic model.

- No lags in adjustment.

- APS and MPS are equal.

- Capital output ratio and propensity to save are constant.

Limitations of the Harrod-Domar Model of Economic Growth

This model has been criticized on the following grounds –

- The HDM model is criticized for unrealistic assumptions. The assumption of the constant propensity to save and capital output ratio is questioned or criticized by many economists. If these parameters change, there would be the change in requirements of steady growth.

- The HDM is constructed on basis of aggregates and does not show the inter-relations between the sectors and hence does not demonstrate the structural changes. There is a well known theory called ‘Flight from Land’ which states that as an economy grows, there is change in the relative importance of the three sectors, namely, primary, secondary and territory. Territory sector becomes more and more important with growth.

- HDM is also criticized for assuming requirements of capital and labour per unit of output are constant i.e. capital-output ratio and labour-output ratios are constant. Actually, different factors of productions are not perfect substitutes but can be substituted for each other to a limited extent.

- The HDM is concerned about steady growth but is neglecting the rate of growth. However, the aim of developing countries is to increase rate of growth. Developed countries might take steady growth as an important objective but developing countries are not as bothered for stability as they are for the rate of growth. Rather, they would get willing to compromise stability to attain a higher rate of growth.

- HDM model is based on laissez-faire policy. Hence, it is not relevant for developing economies particularly those in which government is playing a dominating role like India and China. It is no where incorporating the role of government tin influencing the growth process in the economy.

FAQs

What is the Full Form of HDM?

Ans. Harrod Domar Model.

What is the Full Form of APS?

Ans. Average Propensity to Save.

What is the Full Form of MPS?

Ans. Marginal Propensity to Save.

Conclusion

So friends, this was the basic concept of Harrod-Domar Growth Model. Hope you get the full details about it and hope you like this article.

Read More Articles

⇒ What is HDI how it is Calculated | Human Development Index

⇒ Capital Accumulation | What is Capital Accumulation in Economics?