The incidence of tax is different on the basis of elasticity of supply. We know that there are five different types of elasticity of supply. In today’s article we are going to know about shifting of tax. So let’s discuss this.

Table of Contents

Shifting of tax under different supply condition

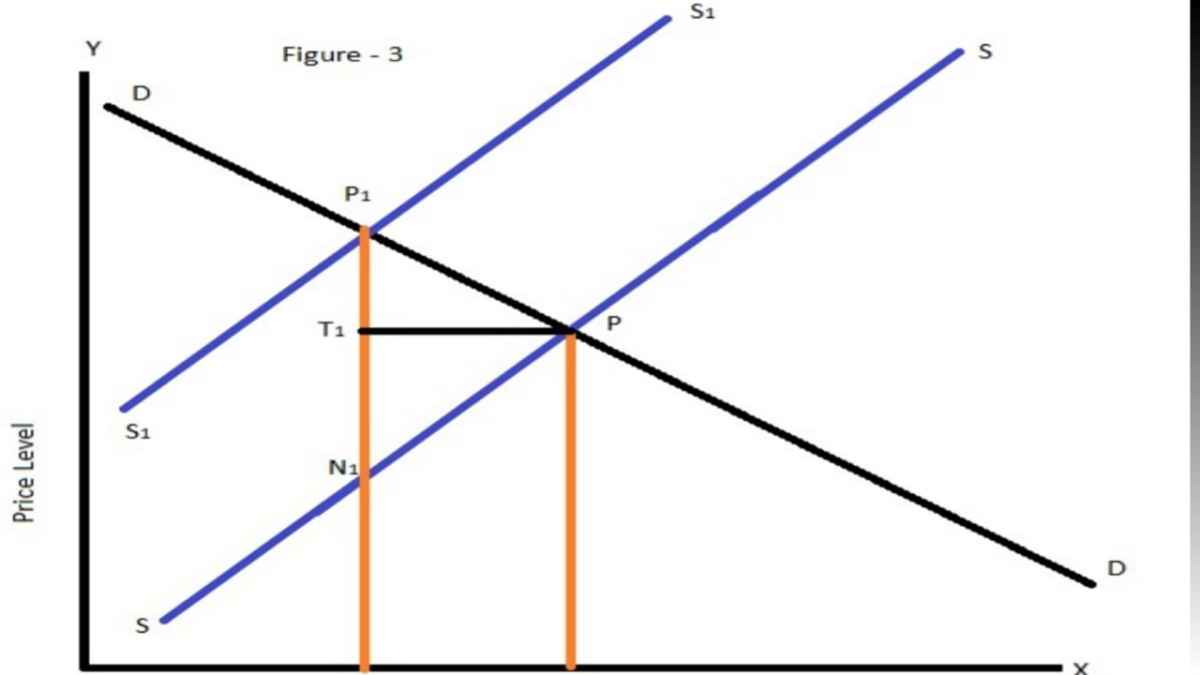

Perfectly elasticity of Supply

When the supply of the commodity is perfectly elastic. The entire burden of tax will be upon the buyers. This is shown in the figure-

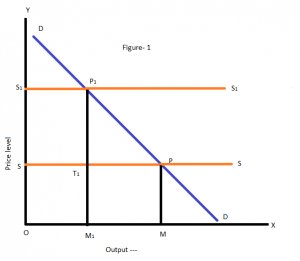

Perfectly inelasticity of Supply

If the supply of the commodity is perfectly inelastic, the entire burden will be upon the seller. In figure 2, SS is the perfectly inelastic supply curve. OP is the price level before the imposition of tax.

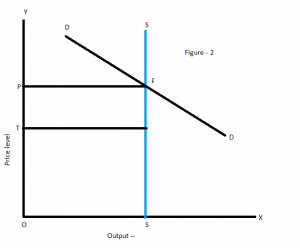

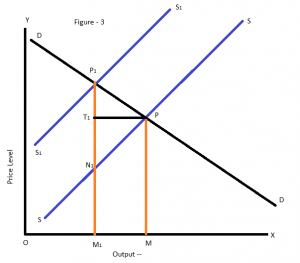

Unitary elasticity of supply

If the supply of a commodity is unitary elastic, the burden of tax will be equally distributed between buyer and seller. This is shown in the figure 3.

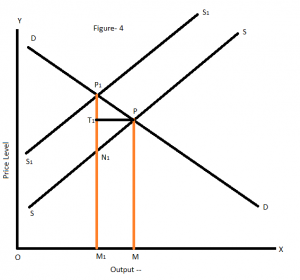

Relatively inelasticity of supply

When the supply of a commodity is relatively inelastic, the seller bears the larger amount of tax. This is shown in the following figure – 4.

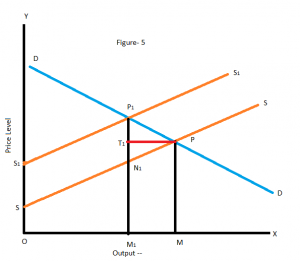

Relatively elasticity of Supply

When supply of a commodity is relatively elastic. The larger amount of tax is bear by buyer. This is shown with the help of the figure – 5.

Conclusion

So friends, this was the shifting of tax. Hope you get the full details about it and hope you like this article.

If you like this article, share it with your friends and turn on the website Bell icon, so don’t miss any articles in the near future. Because we are bringing you such helpful articles every day. If you have any doubt about this article, you can comment us. Thank You!

Read More Article

• Shifting of Tax under different demand condition | Taxation