Shifting of tax is influenced by the nature of elasticity of demand. We know that there are five different types of elasticity of demand. In today’s article we are going to know about Shifting of Tax under different demand condition (Taxation). So let’s discuss this.

Table of Contents

Shifting of Tax

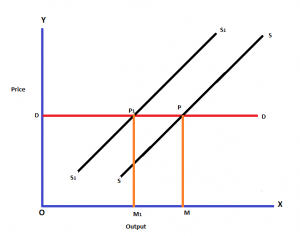

Perfectly Elasticity of demand

If the demand for a commodity is perfectly elastic, the whole burden of a tax will be borne by the seller. In this case price can not be increased. This is shown in the below figure-

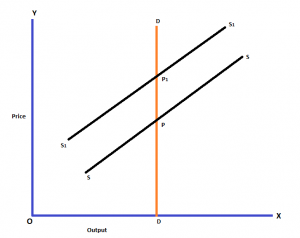

Perfectly Inelasticity of demand

If the demand for a commodity is perfectly inelastic the whole burden of a tax will be borne the consumer. In this case price can be increased. This is shown in the following figure-

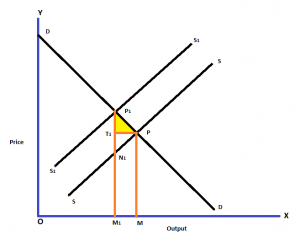

Unique elasticity of demand

If the demand for a commodity is equal to one (Unique elastic), the burden of tax is equally distributed between buyers and sellers. This is shown in the below figure-

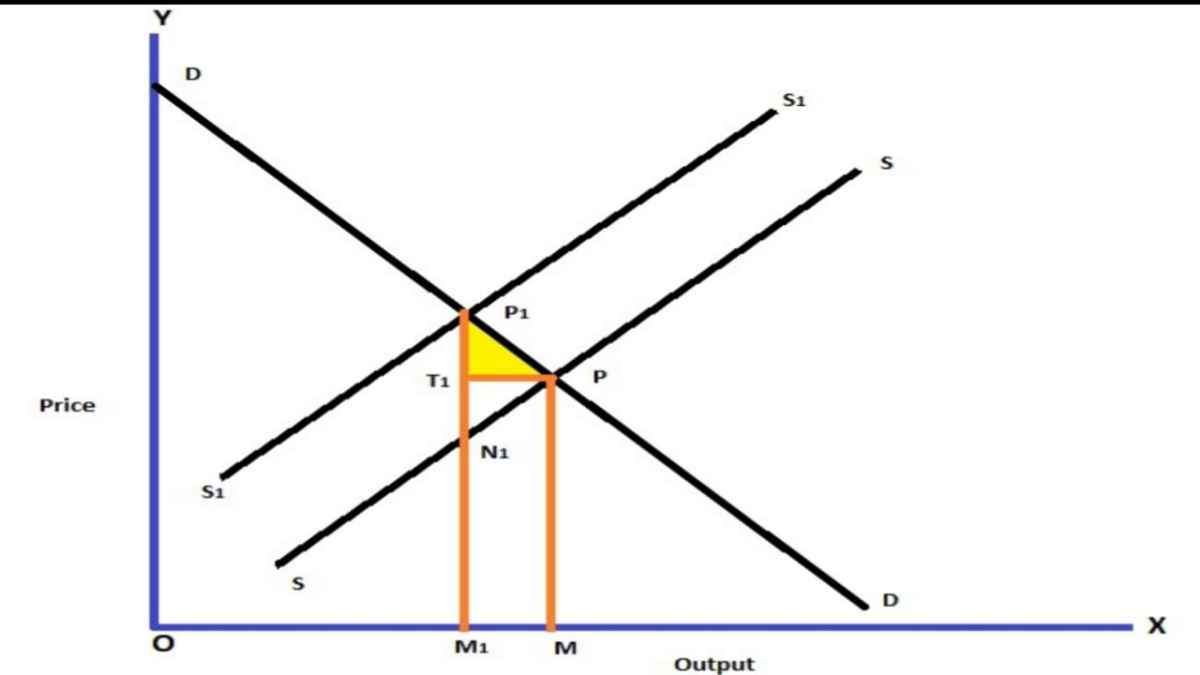

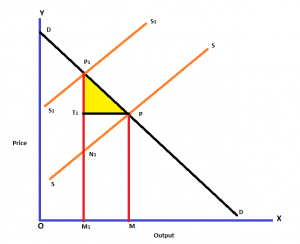

Relatively inelasticity of demand

If the demand for a commodity relatively inelastic (less than 1), the buyers borne. The larger burden of tax then the seller. This is shown in the following figure-

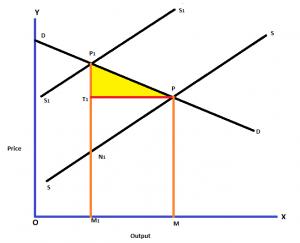

Relatively elasticity of Demand

If the demand for a commodity is relatively elastic (greater than 1), the seller borne the larger burden of tax than the buyers. This is shown by the following figure-

Conclusion

So friends, this was Shifting of Tax under different demand condition (Taxation). Hope you get the full details about it and hope you like this article.

If you like this article, share it with your friends and turn on the website Bell icon, so don’t miss any articles in the near future. Because we are bringing you such helpful articles every day. If you have any doubt about this article, you can comment us. Thank You!

Read More Article

• Progressive tax, Regressive and Proportional tax | Note on Taxation System