In today’s article we are going to know about Explain critically the benefit of taxation? (Benefit of Tax). So let’s discuss this.

Table of Contents

Benefit of Taxation or Benefit of Tax

According to benefit theory of taxation, the burden of tax must be in proportion to the benefit received by a person from the expenditure made by the government. The person receiving equal benefits from the government should pay equal amount as taxes and those receiving greater benefits should pay more as taxes than those receiving less benefits.

The govt. should not impose the taxes greater than the benefits received by the tax payers. Thus taxation is just like a price for the services provided by the government.

In this way, this theory emphasises that justice in taxation should be done it taxes are imposed in proportion to the benefit enjoyed by the people from the various services of the government.

Therefore, according to the benefit theory of taxation or benefit of tax. We get-

Aggregate benefit = Total volume of taxes.

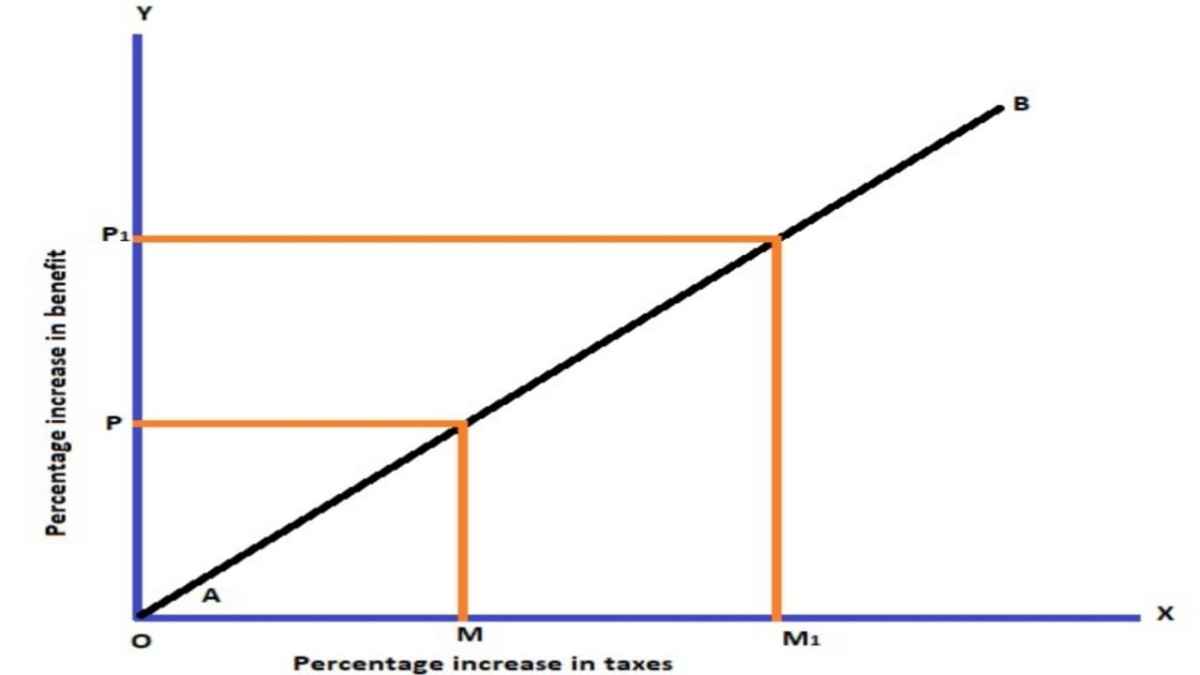

Principle of taxation with diagram

This principle of taxation has been explained with the help of a following diagram. On OX axis we measure percentage increases in taxes. On OY axis we measure percentage increase in benefit. Here AB is the benefit line.

Criticism of benefit of taxation or benefit of tax

The benefit theory of taxation or benefit of tax has been criticised on the following ground-

(i) According to critics, the benefit principle does not obey the principle of justice. This is because poor people receive higher benefits from the expenditure programme of a govt. Thus according to this the poor should bear higher taxes. But this is an unrealistic conclusion.

(ii) Government provide different types of services to the community, as a whole, not an individual basis. Therefore in such a situation we can not use benefit principle to distribute the tax.

Conclusion

So friends, this was the benefit of taxation? (Benefit of Tax). Hope you get the full details about it and hope you like this article.

If you like this article, share it with your friends and turn on the website Bell icon, so don’t miss any articles in the near future. Because we are bringing you such helpful articles every day. If you have any doubt about this article, you can comment us. Thank You!

Read More Article

• Shifting of Tax under different demand condition | Taxation